How to use your market intelligence platform tool for strategic analysis?

In times of significant turbulence, every business decision, whether operational, tactical or strategic, deserves to be based on an analysis of the information and knowledge useful for making said decision.

This strategic analysis work is more than desirable because it allows us to navigate cautiously in an uncertain and changing environment, but also because it ensures that the actions undertaken are aligned with the organization's long-term objectives, thus optimizing the chances of success and resilience in the face of emerging challenges.

In order to continue to increase their added value, monitoring approaches must therefore continue to evolve, enrich their practices, produce more analytical deliverables, thus moving from a logic of monitoring and editorializing newsletters to more detailed analytical productions, in response to the specific needs expressed by the company's departments and businesses.

In this article, we illustrate how companies can rely on their monitoring tools to carry out their studies and analyses.

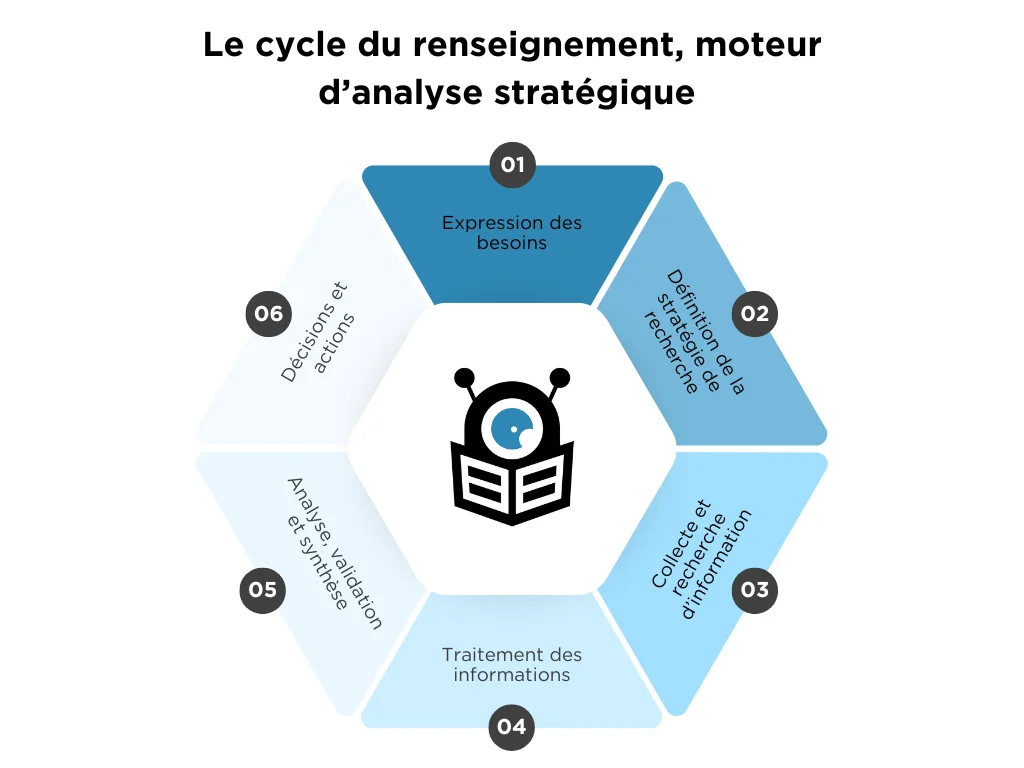

Whatever the type of deliverables you plan to produce, whatever the analysis method (SWOT, PESTEL, Risk Matrix, etc.) you will rely on to facilitate and secure decision-making; your work must be part of and follow the intelligence cycle.

Also called the information management cycle, this provides a framework and the safeguards necessary to produce insights that will be useful to your organization.

No useful strategic analysis without a precise expression of needs

The process often begins with a request for a study, a note, or a benchmark that reflects a client's expression of need. These productions can require a wide variety of expertise, data, and information. It is therefore in your best interest to obtain as precise an expression of need as possible to avoid wasting time researching, studying, analyzing, and producing deliverables that only partially meet real needs.

Expression of needs: To properly initiate an analysis process, it is crucial to clearly define the context, issues, and ambitions, as well as to formulate research questions and hypotheses. The expression of needs can be refined during regular interviews with the client, in order to precisely and gradually define the scope of the analysis. The clearer the need, the easier it will be to implement an analysis method targeted to the desired subject.

Research resources: it is also important to define the resources allocated to carry out this analysis, whether it is your internal time to allocate or that of the people you can call upon, external budgets that can possibly be mobilized, internal data that you can access, etc.

Defining the research strategy: This step involves identifying key players and relevant keywords, and beginning to collect information sources and information resources of interest. This work will continue throughout the study. Analysts should also take the time to familiarize themselves with the topic by reading reference studies and articles. A research plan should be established, segmented into more specific research areas to enable incremental work to be implemented over the long term.

Implementation in your market intelligence platform

- In this step, you can already begin to capitalize on and qualify the first information resources of interest that you identify: pre-existing internal study, external study identified during your research, article, etc.

- It is also interesting to initiate an exploratory watch within Curebot with the first outlined keywords, the obvious actors, etc.

- Using the platform, begin configuring your monitoring environment. Use the axes defined upstream to segment your monitoring into specific research streams and prepare a classification of qualified information drawn from these information streams.

- Structure your work using a dashboard with multiple tabs. One tab displays an overview of the various flows generated, and another tab capitalizes on studies and articles.

Research and information gathering: From the studies and reference articles, you can build a solid body of documentation: detailed files must be developed for the actors, companies, and experts, and key figures must be identified. Interviews and other complementary research are necessary to enrich the approach. It is imperative to update the storage space of relevant documents. The quality of the necessary information sources is enriched quantitatively and qualitatively. At this stage, the configuration of the tools used in research and collection is refined.

Implementation in your market intelligence platform

- Exploratory monitoring results can be analyzed to refine keywords for specific search streams. Clustering algorithms allow you to identify topics covered in large data streams. They also allow you to identify weak signals.

- Add the newly identified sources and eliminate less relevant sources from each specific search flow; evolve your queries to refine your monitoring flows.

- Using your dashboard, classify qualified information and store it in the appropriate folders. Explain the value of the resources by commenting on them and providing your initial analytical insights.

- Feel free to create new tabs in your dashboard to have a visualization of this qualified and classified information with their corresponding analyses.

Information Processing: This step aims to harmonize the collected information. It is important to have a list of available internal experts. Categorization criteria must be validated, and the information must be enriched, validated, cross-referenced, or categorized. In this step, revisit your qualified information to cross-reference the analyses. Also begin creating analysis grids that will seek to address the issues identified during the needs assessment.

Implementation in your market intelligence platform

- In your dashboard, create an additional tab for each analysis grid. (SWOT, Pestel, Risk Analysis Grid, Effort Impact Matrix, etc.)

- In your dashboard, create a new tab to capitalize on analysis deliverables from third-party tools as well as the first analysis reports.

Analysis, evaluation and decision making

Analysis, validation, and synthesis: After gathering sufficient information, a cross-sectional analysis must be conducted. It is necessary to create a timeline of events and map the stakeholders. The impact analysis must be structured to address the issues identified in the statement of needs. Analysis grids, such as SWOT, PESTEL, or the risk analysis grid, can be produced.

Implementation in your market intelligence platform

- Create or import documents to capitalize, categorize and distribute productions from other tools.

- You can produce a final report. Qualified information can be re-mobilized for this report.

Decision and Action: Finally, it's important to determine the formats for disseminating the information. It should be presented clearly and concisely to stakeholders, allowing for decisions to be gathered and an action plan to be established. The analysis should be shared, and an evaluation questionnaire can be administered. It's essential to share and integrate feedback. Communication materials, comments, and feedback should be retained for future reference.

Implementation in your market intelligence platform

- Build a Dashboard or a dashboard to present the collection methodology, analysis and results.

- Make the monitoring environment and dashboard available to the sponsor for continuous monitoring of the relevance of the analysis.

- You can also create alerts on the most relevant topics and elements that should continue to be monitored, in addition to your analysis.

- Create a tab in your dashboard to call up the specific flows for this opening watch.

Collaborative strategic analysis: best practices for maximizing collective intelligence

Analytical and monitoring work requires the implementation of good collective intelligence practices. Indeed, analytical work is often of cross-functional interest and requires a wide variety of expertise. The idea is to leverage the knowledge of business experts as much as possible to integrate them into the analysis. The most modern collaborative market intelligence platforms now allow you to integrate relevant collaborators into your strategic monitoring and analysis, as well as your foresight efforts.

Focus on some good practices to put in place to make strategic analysis a collaborative affair:

Clearly define the rules of the collaborative analysis game

As with any project, it is essential to plan actions, to divide the actions to be carried out, to designate the leaders, the responsibilities and accountabilities of the contributors, the milestones and deadlines.

Share your monitoring, Dashboard, documents and source catalogs

When the analysis unit begins its study, it's important to implement your platform's collaborative best practices. Start by creating a working group to share the various objects created in the platform (monitoring, files, and dashboards). Sourcing work will never be as rich as if it's carried out collaboratively, relying on the knowledge of sources and the expertise of your mobilized network. Create source catalogs that can be reused by all users.

A shared and continuously enriched knowledge base

At this stage, you can leverage dashboard customization to create team engagement and stay aligned on goals and issues. For example, you can create a tab to capitalize on all the resources qualified by each team member. Mention your colleagues to notify them of specific resources you've commented on to initiate reflection and discussion around this information.

Maintain a connection with your contributors

Very simply, you can also set up a newsletter on the platform to regularly share the latest news on the topics and the analyses associated with them.

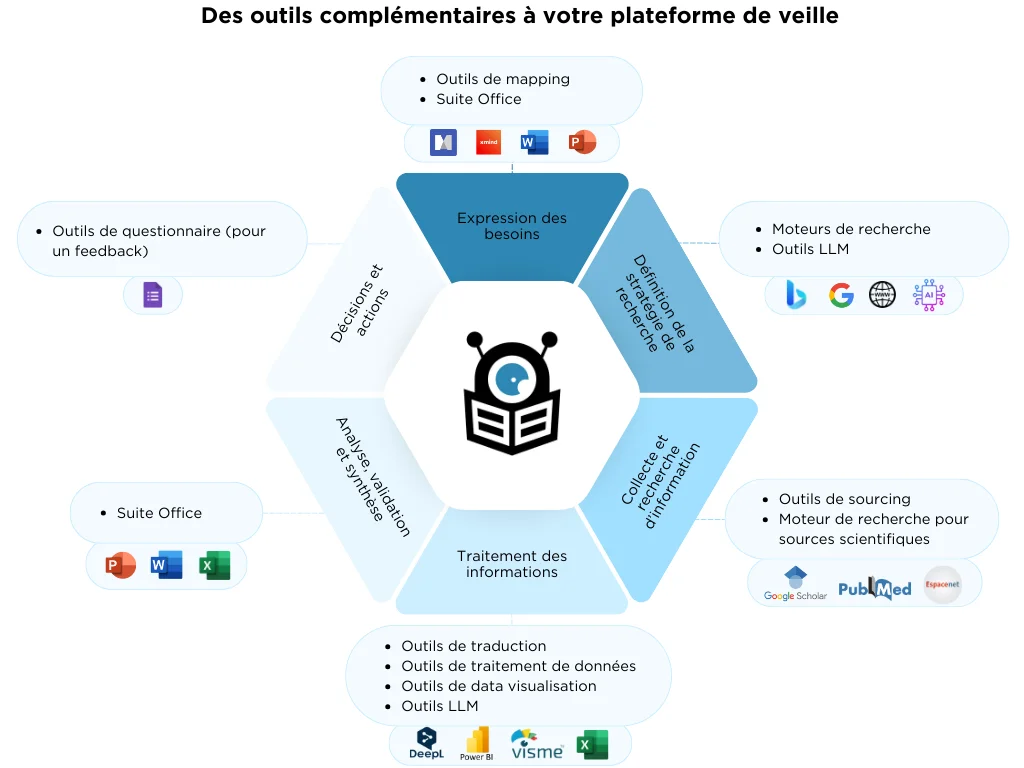

The importance of tool complementarity: How Curebot fits into the analyst’s “starter pack”.

A seasoned analyst must master a wide range of tools to produce the most comprehensive analyses possible. While a collaborative monitoring platform is essential for supporting monitoring, analysis, and forecasting activities, knowledge and mastery of complementary tools is equally critical for any analyst who wants to support their company's competitiveness.

Follow us on LinkedIn